Instant Transactions Redefined: A Comprehensive Review of Sofort Payment System

As digital transactions become the backbone of our economy, the need for secure and instant payment solutions has never been greater. Sofort, a payment system that has gained popularity for its swift and straightforward approach to online transactions, promises to be the solution many consumers and businesses are looking for. Designed for an audience ranging from tech-savvy millennials to seasoned entrepreneurs, our review of Sofort will dive deep into its features, security measures, and overall usability. Whether you’re an online shopper or a business owner, understanding the intricacies of Sofort could significantly streamline your digital payment experience.

The Inner Workings of Sofort: How It Stands Out

Streamlined Online Payments

Sofort’s unique selling point is its streamlined payment process. Users can make direct transfers from their bank accounts without needing to create additional accounts or wallets. This not only simplifies the transaction process but also reduces the time spent on checkout. We’ll explore how Sofort’s direct approach compares to other online payment systems in terms of efficiency and user experience.

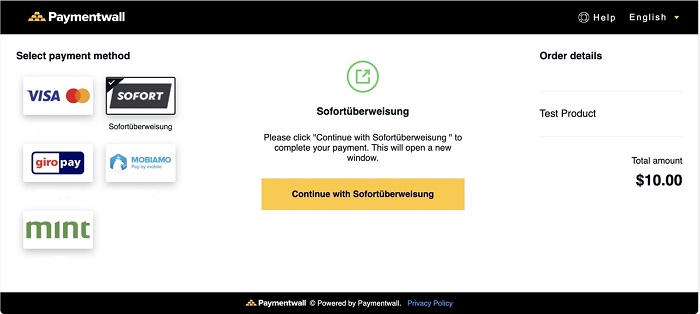

User-Centric Design

The design of a payment system plays a critical role in its adoption. Sofort’s user interface is clean and intuitive, making it accessible for users of all ages and technical backgrounds. The ease with which transactions can be reviewed and confirmed is a testament to its user-centric approach.

Compatibility and Integration

A payment system must be widely compatible to be truly effective. Sofort scores high on this front, with broad integration across various online shopping platforms and financial institutions. We examine the scope of Sofort’s compatibility and how it facilitates seamless transactions across different platforms.

Safety First: Assessing Sofort’s Security Features

Bank-Level Security Protocols

Security is paramount in the world of online transactions. Sofort incorporates bank-level security protocols to protect users’ financial data. We delve into the specifics of these protocols, how they work to prevent fraud, and what this means for the end-user.

Data Protection and Privacy

With data breaches on the rise, a payment system must also be a fortress of privacy. Sofort’s commitment to data protection is evident through its compliance with European data protection standards. Our review assesses the robustness of Sofort’s privacy measures and how they safeguard user information.

Real-World Applications: Who Benefits from Sofort?

The Consumer Experience

For consumers, Sofort brings the promise of instant, hassle-free payments. We discuss how this impacts the online shopping experience and what it means for consumer satisfaction and trust in digital marketplaces.

The Merchant Perspective

Merchants stand to gain from Sofort’s rapid settlement times and reduced risk of chargebacks. We analyze the advantages Sofort presents to businesses and how it can potentially improve cash flow and customer relations.

Comparative Analysis: Sofort in the Payment System Landscape

Sofort vs. Traditional and Modern Competitors

In a market crowded with payment options, how does Sofort stack up against traditional systems like credit cards and modern services like e-wallets? Our comparative analysis looks at fees, transaction speeds, and market acceptance to draw distinctions.

International Usability

While Sofort is widely used within Europe, its functionality across borders is a point of consideration for international users. We explore Sofort’s capabilities in the global market and its potential for international expansion.

Concluding Thoughts: Is Sofort the Future of Online Payments?

Prospects and Potential

Our comprehensive review concludes with a reflection on Sofort’s future in the digital payment space. We weigh its prospects and potential to revolutionize online transactions against the challenges it may face in a rapidly evolving digital economy.