N26 Payment Solution: A New Age Banking Experience

In the fast-paced world of online transactions and digital banking, a revolutionary player has emerged, challenging traditional banking norms and offering a fresh perspective on financial management. The N26 payment solution, a brainchild of innovation and convenience, is reshaping the landscape of digital banking, making waves among users who demand speed, security, and simplicity in their financial dealings. This article delves into the world of N26, exploring its unique advantages, potential drawbacks, and how it seamlessly integrates into the online casino experience.

Story

Founded in 2013, N26 embarked on a mission to simplify banking for the digital age. It quickly distinguished itself with its user-friendly app, transparent policies, and a commitment to customer experience. As a mobile-first bank, N26 has revolutionized personal finance, becoming a preferred choice for digital-savvy users across the globe.

Advantages and Disadvantages

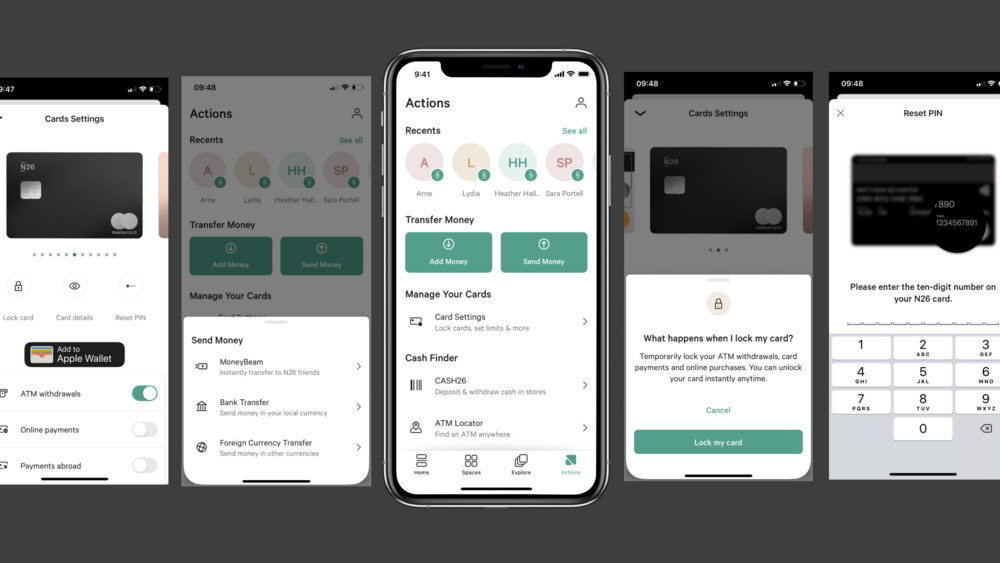

N26 offers numerous advantages, including real-time transaction notifications, no foreign transaction fees, and an intuitive app that makes banking accessible and straightforward. However, it’s not without its disadvantages. The lack of physical branches might deter those who prefer traditional banking, and certain services like depositing cash can be more complicated.

How to Use N26 in an Online Casino

Integrating N26 into your online casino experience is straightforward. Begin by ensuring that your chosen casino supports N26 as a payment method. Once confirmed, you can directly link your N26 account for deposits and withdrawals, enjoying a seamless transaction process that is both quick and secure. This integration not only simplifies the payment process but also brings the benefits of N26’s advanced security features to your casino experience.

Regions

N26’s availability varies by region. Originally focused in Europe, it has expanded to several international markets, but its services and features might differ depending on the country. It’s advisable for users to check the availability and specific offerings in their region.

Payment Methods

N26 provides diverse payment methods, including bank transfers, direct debit, and mobile payments. Its flexibility caters to a wide range of user preferences, ensuring a convenient banking experience for various transaction needs.

Customer Support

N26 is known for its strong customer support, providing assistance via in-app chat, email, and phone. The bank’s focus on customer service is evident in its responsive support team, equipped to handle inquiries and resolve issues efficiently.

Safety

Safety is a cornerstone of N26’s services. The bank employs robust security measures, including two-factor authentication, face recognition, and fingerprint unlocking for its app. These features ensure high levels of security for user funds and personal information.

N26 stands as a beacon of modern banking, embodying the ideals of convenience, security, and innovation. While it navigates the challenges of a digital-only platform and limited regional availability, its advantages significantly outweigh its disadvantages. For online casino enthusiasts and digital nomads alike, N26 offers a banking experience that aligns with the demands of the new age. As it continues to expand and evolve, N26 promises to redefine our expectations of what banking can be, marking the dawn of a new era in financial management.