Klarna Payment System: Revolutionising Online Transactions

The Klarna payment system has become one of the most prominent solutions for online shoppers and merchants alike. Founded in Sweden in 2005, Klarna has quickly established itself as a key player in the world of digital payments. In this article, we will explore how Klarna functions, its benefits for consumers and businesses, and how it has reshaped the e-commerce landscape.

Understanding Klarna Payment System

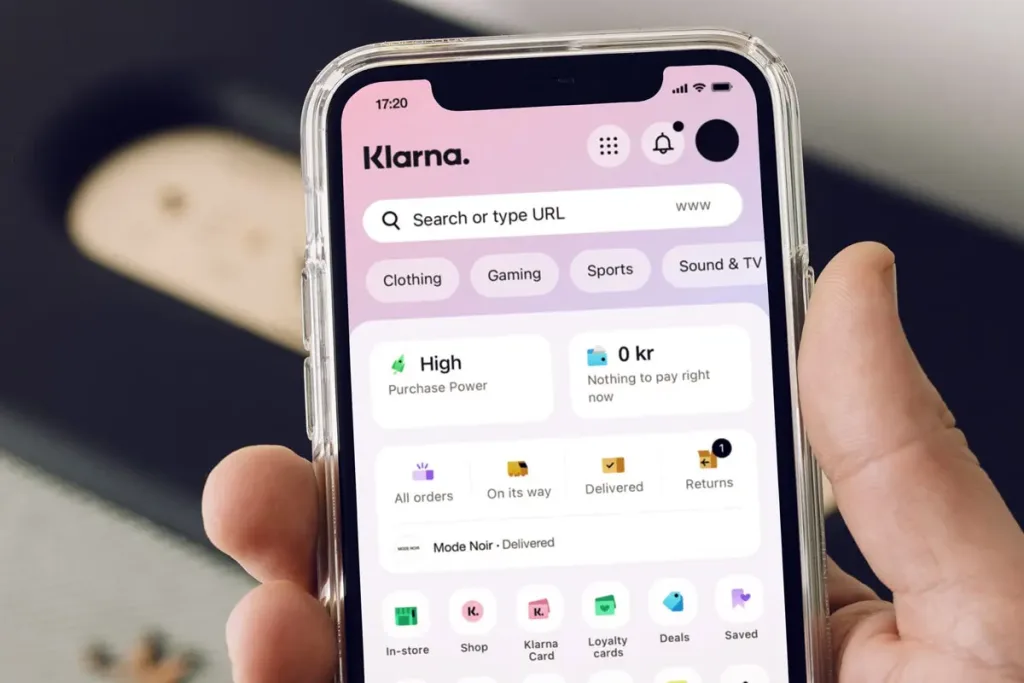

Klarna is a Swedish payment provider that offers a range of financial services, primarily focusing on facilitating smoother online payments. It provides a variety of solutions for both consumers and merchants, ensuring a frictionless and secure shopping experience. Klarna’s services include ‘Pay Later’, ‘Pay Now’, and ‘Financing’, making it a versatile option for consumers looking for flexibility in how they settle their purchases.

One of the key features of Klarna is its ability to allow consumers to purchase goods online and pay for them later, often within 14 or 30 days, without incurring any interest or fees if paid on time. This model is extremely popular among shoppers who want the ability to try before they buy, reducing the perceived risk of online shopping. Additionally, Klarna offers financing options for larger purchases, which can be spread over months. This makes Klarna a comprehensive solution, catering to a wide range of consumer needs.

By offering ‘Pay Later’ options, Klarna removes the immediate financial burden of an online purchase, giving shoppers the flexibility to delay payments. This is particularly helpful for consumers who might want to check the quality of a product before committing to payment, making Klarna an appealing choice for cautious buyers. Klarna’s payment solutions are growing rapidly in popularity, offering retailers and customers alike a modern alternative to traditional payment methods.

How Klarna Works for Consumers

For consumers, Klarna operates on a simple premise: the ability to shop now and pay later. This service is designed to reduce the friction typically associated with online purchases. When using Klarna at checkout, shoppers can choose to either pay immediately or opt for a deferred payment plan. Klarna allows consumers to pay in instalments or delay payment for up to 30 days. This model provides flexibility, especially for larger purchases, and gives users more control over their finances.

Using Klarna is straightforward. Once a shopper selects Klarna as a payment method during checkout, they are redirected to Klarna’s platform where a quick credit check is performed. If approved, the customer can complete their purchase and enjoy their product without paying upfront. Payment options are tailored to suit the user’s preferences, which makes Klarna ideal for people who are budget-conscious or want to spread out payments without interest.

For example, Klarna also offers instalment options, where the total cost of an item can be divided into smaller, more manageable payments over a longer period. This makes it easier for consumers to make higher-value purchases without having to pay everything at once. This flexibility is a core part of Klarna’s appeal, making it one of the leading alternatives to traditional credit cards in e-commerce.

Benefits of Klarna for Businesses

For online merchants, Klarna presents a significant opportunity to increase sales and improve the overall customer shopping experience. By offering Klarna as a payment option, businesses can cater to a growing segment of consumers who prefer flexible payment terms. Klarna’s easy integration into e-commerce platforms means that merchants can adopt it with minimal effort and without the need for complex technical setups.

Merchants also benefit from Klarna’s ability to reduce cart abandonment rates. Many online shoppers abandon their carts at the final stage of checkout due to concerns over payment. Klarna’s “buy now, pay later” model addresses this issue by offering flexibility in how and when payments are made. Studies show that retailers who offer flexible payment options like Klarna experience a reduction in cart abandonment and a corresponding increase in conversion rates.

Another advantage for merchants is Klarna’s assumption of the financial risk. When a customer chooses to pay later or in instalments, Klarna takes on the responsibility of collecting payments, ensuring that merchants receive full payment upfront. This means that even if a customer opts for delayed payments, the merchant can rest assured that their revenue is secure. Klarna also offers fraud protection, further reducing risks for businesses.

Klarna’s Impact on E-commerce

The integration of Klarna has made a significant impact on how people shop online. With over 250,000 merchants offering Klarna as a payment option globally, the platform has become synonymous with convenience and security. Klarna has been instrumental in the rise of flexible payment solutions that cater to modern shoppers who expect convenience, simplicity, and choice when making purchases online.

Additionally, Klarna has positioned itself as a leader in the digital payment space by providing a seamless, frictionless checkout experience. Its growth is a testament to the demand for innovative payment solutions that meet the needs of today’s digital economy. The flexibility Klarna offers not only benefits consumers but also gives merchants a competitive edge in the crowded e-commerce marketplace.

Moreover, Klarna’s ability to reduce the financial risk for merchants makes it an attractive payment option in the competitive world of online retail. As more consumers expect flexible payment options, merchants who adopt Klarna are positioning themselves as forward-thinking businesses that understand the changing dynamics of consumer expectations.

The Future of Klarna and Digital Payments

Looking ahead, Klarna’s influence in the payment industry is set to grow even further. As the e-commerce sector continues to expand, the demand for flexible payment options will increase, and Klarna’s platform is well-positioned to meet these needs. Klarna is continuously evolving, with plans to introduce new technologies, expand into new markets, and integrate more personalised features into its payment offerings.

The future of Klarna lies in its ability to adapt to the rapidly changing landscape of digital payments. As mobile payments, digital wallets, and other forms of contactless payment continue to rise in popularity, Klarna is positioning itself to be a central player in the ongoing shift towards a cashless economy. The company’s commitment to providing seamless payment solutions means it will remain a vital player in the digital payment ecosystem for years to come.

Furthermore, Klarna’s growth is aligned with the increasing demand for secure, easy-to-use payment systems. With data breaches and fraud becoming more prevalent in the digital world, consumers and businesses alike are looking for payment providers that prioritise security and trust. Klarna’s track record of ensuring secure transactions will continue to make it an attractive option for both consumers and businesses.

What Lies Ahead for Klarna

In the coming years, Klarna is expected to integrate even more cutting-edge technologies such as artificial intelligence and machine learning. These technologies will allow Klarna to offer even more tailored and personalised payment options, improving the overall customer experience. Furthermore, Klarna is likely to expand its services to new regions, giving more consumers and businesses around the world access to its innovative payment solutions.

Additionally, as consumer demand for sustainability and ethical business practices increases, Klarna’s transparency and commitment to customer satisfaction will likely play a pivotal role in its long-term success. The ability to adapt to changing consumer preferences, while maintaining a strong commitment to security and reliability, will ensure Klarna remains a dominant force in the evolving world of digital payments.